Morris Tax & Accounting

Practical Financial Advice You Can Count On

.

Trusted | Experienced | Professional

Invest your time and efforts on running your business. Leave the accounting to me

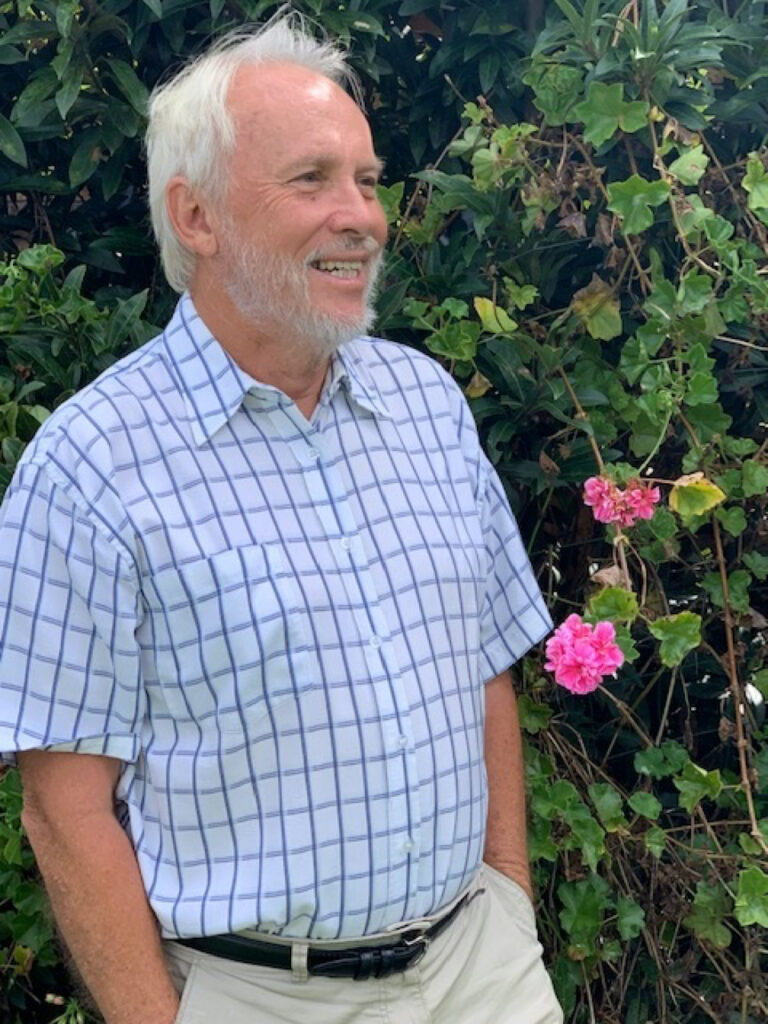

Peter Morris CPA

Accountant, Tax Agent, Company & Super Fund Auditor

Peter Morris has been in professional accounting for over 40 years. Peter is a registered tax agent, company auditor and superannuation fund auditor.

He is a member of CPA Australia and Tax & Super Australia.

Peter has a wealth of knowledge relating to small businesses and personal tax. He has been a partner of an accounting practice and has operated his own accounting practice for 25 years.

In 2009, Peter sold his accounting practice to a larger firm where he worked as an associate for a time. After taking a break, he has decided to recommence a new practice specialising in small business and personal tax.

He intends to grow this new tax and accounting practice. He is looking for proactive business and personal clients who wish to grow their businesses and incomes.

He looks forward to meeting up with you to discuss your business issues. Please give him a call to discuss your business and tax issues.

SERVICES

What I do

01.

Tax Services

We provide tax advice and tax planning for our clients to minimise the legal amount of tax payable.

Our firm can attend to tax compliance and navigate you through the maze of tax obligations.

We attend to your tax return preparation, lodgement and checking the ATO assessments.

02.

Accounting & Bookkeeping

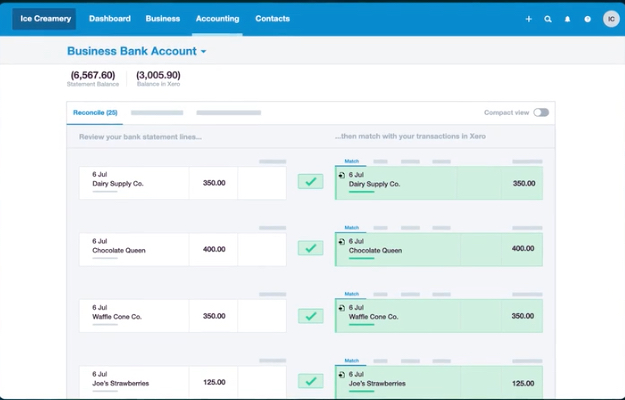

Our team is happy to work on your accounting software, whether desktop versions or cloud accounting in MYOB, QuickBooks, Xero. Then we produce financial accounts directly on your software system. So avoiding those issues where accountants take your data and produce financial accounts on their systems that do not reflect in your software.

We also process and attend to the bookkeeping from bank statements, excel worksheets and manual systems.

03.

Business Activity Statements

Our team prepare monthly, quarterly and annual statements for GST and PAYG withholding – completing BAS returns.

Personalised service.

Our team members offer a personalised service to our clients and business owners.

04.

Personalised Service

Our team is happy to work on your accounting Our team members offer a personalised service to our clients and business owners

05.

Business & Corporate Services

Our team works with business owners in helping them grow their businesses and ensuring they meet all their taxation, ASIC and other

legal requirements.

06.

Single Touch Payroll

Single Touch Payroll (STP), is an Australian Government initiative to reduce employers’ reporting burdens to government agencies. With STP, you report employees’ payroll information to us each time you pay them through STP-enabled software. We can attend to your Single Touch Payroll needs either in your software or ours.

We have meeting rooms at Chatswood as well as an office at Allambie Heights

We have meeting rooms at Chatswood as well as an office at Allambie Heights

Postal Address

PO Box 311

Frenchs Forest NSW 1640

Office Address

18 Canea Crescent

Allambie Heights 2100

Get Intouch with Peter Morris CPA

Accountant, Tax Agent, Company & Super Fund Auditor

0412551888

Email

peter@morristax.com.au

Peter Morris – ABN 66 055 923 628

Peter Morris & Co Pty Ltd – ABN 24 079 145 805

Agreed Terms of Engagement

Liability limited by a scheme approved under Professional Standards Legislation

Contact Morris Tax & Accounting

Give Us a Call To Discuss Your Accounting Issues